FY2012 was a very challenging year for the Indian economy. The year witnessed turmoil as the GDP growth rate came down to 6.5%, the lowest in the last 5 years. This was a result of the various macro-economic factors, global economy being at the brink of a recession, financial turmoil in the Euro zone and slowdown in the economic decisions (or lack of them) by the Indian Government and the 13 consecutive interest rate hikes by the Reserve Bank of India (RBI).

Amidst a slowdown in economic growth, the Indian real estate sector continued to face a challenging environment. With an overall decline in volumes, pricing was a key issue in some geographies marked by over-supply and lack of sustained economic activity. Key markets were also impacted by policy inertia, leading to significant reduction in volumes on account of lack of fresh approvals.

On the regulatory front, the Indian govt has proposed Land Acquisition Bill and Real Estate Regulation and Development Bill. These Bills are yet to achieve consensus and enactment.

FY12 was characterized by sustained rise in inflation because of a sharp increase in the prices of commodities. This was further exacerbated by the supply side constraints and increased borrowing costs. The RBI took a cautious /hawkish monetary stance, sacrificing growth over controlling inflation. Whether this was the right approach for India’s condition will only be revealed in hindsight when the combined impact of high cost of capital plus record low GDP growth is available to us a few years from now.

For now, with demand and affordability getting impacted, the Indian economic growth engine has suffered a significant slowdown. And over the near term, there is no sign of reversal of this trend, unless the Indian Government initiates a series of reforms and bold economic measures, which are looking unlikely due to political ambitions of the opposition parties.

Indian Residential Real Estate Review – FY2012

The overall demand in the residential sector witnessed muted growth. However some areas in North India, showed increasing volumes accompanied with price recovery. Mumbai market witnessed a negative growth, as it went through a time correction, due to lack of fresh launches and prices remaining stable. After a long period of regulatory inertia, new Development Control Rules (DCR) norms were introduced in Mumbai market. Bangalore emerged as the strongest region in terms of absorption with an increase of 20% YoY.

The high absorption was attributable to a large number of affordable launches. The capital value trends however depict that the sector managed to sustain or marginally increase the capital values. High mortgage rates played a dampener while increasing inflation aggravated the problems of the sector by adversely affecting the affordability of the consumers. As the interest rate cycle is anticipated to have peaked, the reduction in mortgage rates shall help improve affordability and boost sentiments.

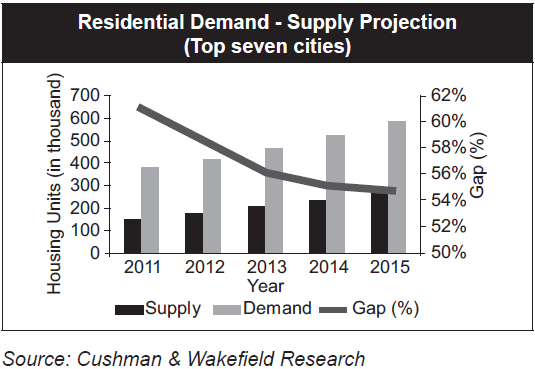

Cushman & Wakefield estimates that the cumulative demand in the residential sector during the period 2011-15 would reach about 3.94 million units growing at a CAGR of 11%.

Indian Commercial Real Estate Review – FY2012

(a) The Office Leasing segment was marked by oversupply in key geographies and slowing of demand on account of lack of fresh investment by international businesses and lack of domestic triggers. This resulted in decline in average rentals in certain geographies, especially Mumbai MMR, Delhi NCR, Bangalore and Hyderabad.

The Commercial offies segment underwent a setback as a result of deferment of expansion and investment plans because of the adverse macro-economic conditions both nationally and globally. The second half witnessed a substantial dropdown in the absorption rate in the commercial segment. The share of the IT/ITES in offce leasing dropped down from 47% in FY11 to 35% in FY12, however, the overall demand levels were sustained due to increase in demand from various other sectors including manufacturing, consulting and telecom. The demand from these sectors rose to 26% this year from 16% in FY11.

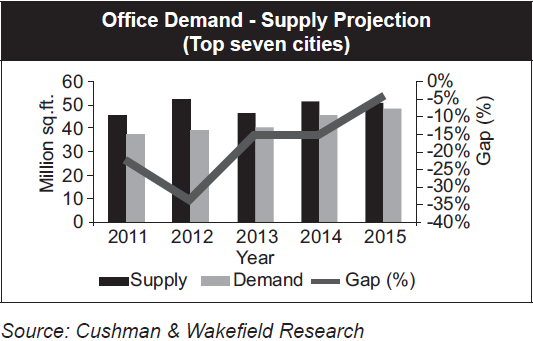

Cushman & Wakefield Research estimates that the cumulative demand of offices during the period 2011-15 would reach 267 msf. Over 47 % of this total demand is attributed to Bengalore, Mumbai MMR and Delhi NCR regions.

(b) The Retail segment witnessed a substantial boost both in terms of leasing activity as well as the completion of the malls. The organized retail market grew over the previous year as many international ‘single brand’ retailers have forayed in the key markets. Though the segment received a slight fillip with Government allowing 100% FDI in single brand retail, the sector will not see a significant recovery till the government is able to work on a political consensus for allowing FDI in multi-brand retail.

Thus, the Retail real estate segment was better, as oversupply in the segment got absorbed with a marginal increase in retail penetration and ill-located malls being put to alternate uses. Some geographies, especially Delhi NCR, saw marginal improvement in rentals. In case of retail leases with revenue sharing, the share of revenues was matching closely to minimum guarantees, implying that as domestic retail picks up, it shall provide boost to retail rentals.

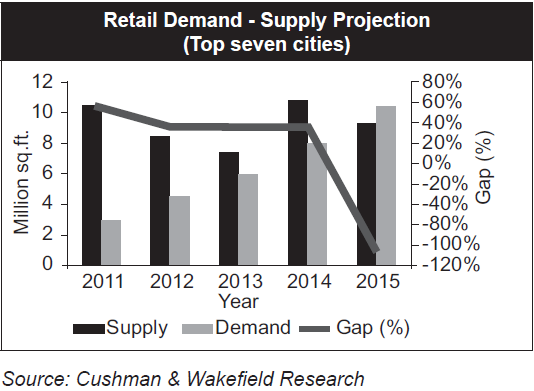

Cushman & Wakefield Research estimates that the cumulative demand for retail during the period 2011-15 would be approximately 57 msf witnessing a CAGR of 37%. Over 43% of the total demand is attributed to Bangalore, Mumbai MMR and Delhi NCR regions. Majority of the operational stock is present in Delhi NCR; however the incremental supply came into other cities, primarily Mumbai and Bangalore.